Disability insurance

All content is checked by medical journalists.An accident or an illness - and suddenly you can no longer do your job. So what? How are you supposed to cover your running costs without income? Little help can be expected from the state, and few people manage to live on what they have saved until they retire. The solution can be a private disability insurance. Here you can find out everything you need to know about this existential security.

Inability to work - what does that mean?

Those who are unable to work can no longer work permanently or temporarily in their profession. In contrast to disability, occupational disability relates to the job that is currently being practiced. On the other hand, being unable to work means not being able to work at all, regardless of the occupation. In Germany, around one in four people is at least temporarily unable to work in the course of their working life. In 2014, for example, 52,000 applications for an occupational disability pension were received by insurance companies in this country, around 40,000 of which were approved.

The causes of occupational disability are diverse. In addition to accidents, illnesses can lead to temporary or long-term occupational disability. These are the most common reasons for disability:

- Depression and other mental illnesses

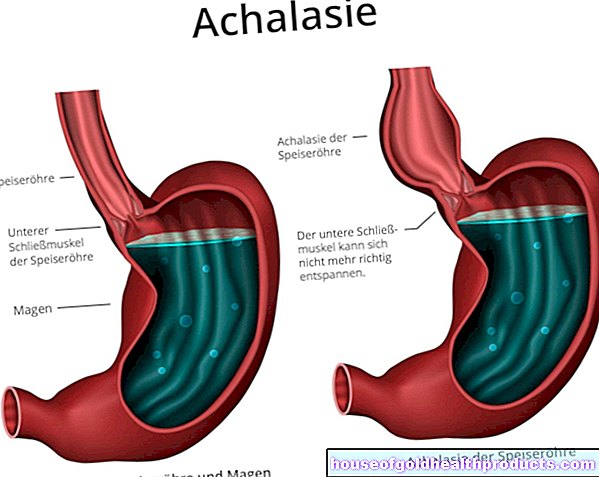

- Nervous system disorders

- Skeletal and musculoskeletal disorders

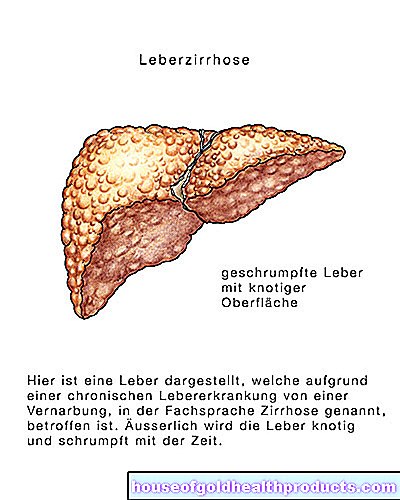

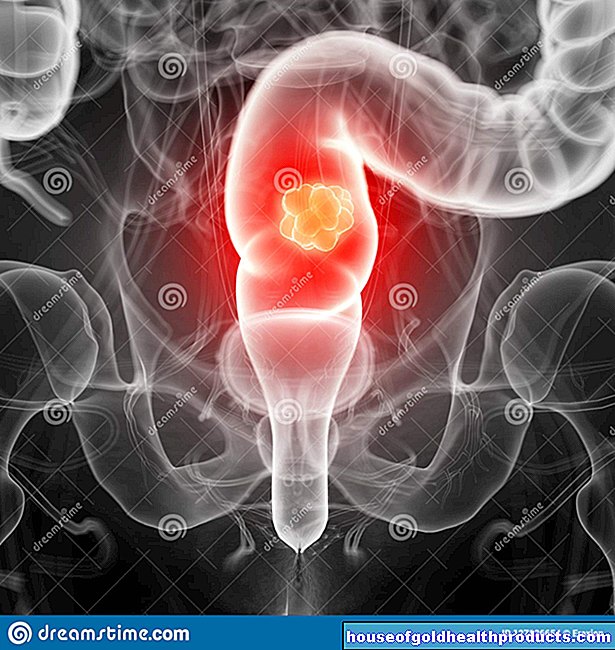

- cancer

- Heart and vascular diseases

It can affect everyone, regardless of age, gender and occupation, employees as well as civil servants and the self-employed. However, there are occupational groups and age groups that are more often affected than others. 56- to 60-year-olds are at the top with a share of 27 percent, closely followed by the group of 51 to 55-year-olds with 26 percent. This is followed by the 36 to 45 year olds with a 20 percent share.

If you look at the occupational groups, manual professions such as scaffolders (52.2%), roofers (51.3%), miners (50.1%) but also bakers (37.6%) are far ahead. In contrast, professions such as physicists (3.6%), doctors (4.1%) and mechanical engineers (4.6%) are much less risky.

But whether a craftsman, scientist or doctor - the consequences of occupational disability are fatal for all those affected. In the case of employees, the sickness benefit from health insurance initially closes the financial gap. But after a few months this support also ends. Anyone who then relies on state benefits quickly realizes that with a maximum of 32 percent of the last gross income, these are nowhere near enough to ensure the accustomed standard of living.

Those born after January 1, 1961 should certainly not rely on the statutory disability insurance. After all, since a change in the law in 2001, they no longer have any entitlement to it. If they become unable to work, they are only entitled to a state disability pension.

In order to be able to obtain these in full, however, those affected must be so impaired that they can only work less than three hours a day, regardless of their occupation. And even if it is possible to claim a complete reduction in earning capacity, the remuneration is well below the state basic security.

Even if the occupational disability is only temporary, the financial losses are clearly noticeable. For example, if you need rehab or take part in retraining, there is also a lack of fixed income during this time.

Why is occupational disability insurance useful?

If you want to effectively compensate for the financial losses associated with occupational disability, private disability insurance is necessary. Because if the worst comes to the worst, it closes the gap between the statutory disability pension and the usual income.

Private occupational disability insurance usually takes effect if you can prove that you are more than 50 percent disabled. Then you get the following benefits:

- the monthly pension agreed in the insurance contract

- the exemption from monthly contributions

The private occupational disability insurance pays for as long as the occupational disability exists, even if you are in need of care.

Occupational disability insurance for the self-employed

It is at least as important for the self-employed as for employees to secure their own workforce. Because if they become unable to work, their income is immediately lost without replacement. Those who do not have disability insurance then run into financial bottlenecks particularly quickly.

Disability insurance - yes or no?

Experts are clearly in favor of taking out private disability insurance. These reasons speak for it:

- Occupational disability can affect anyone.

- The private occupational disability insurance pays out if you can no longer practice your current job.

- The statutory disability pension only takes effect when you can no longer work at all, regardless of your job description.

- The statutory benefits are too low to be able to maintain the usual standard of living.

- The private occupational disability insurance also pays for long-term care.

- The contribution payments can be deducted from tax.

Disability insurance costs

There is no standardized occupational disability insurance that covers every need. Rather, the contracts are adapted individually. That is why you should think carefully beforehand what is important to you. For example, you should ask yourself the following:

- From what level of occupational disability should the insurance take effect?

- Which occupation should be insured?

- How high should the pension be in an emergency?

Ultimately, the answers also determine how high the monthly insurance premiums are. Example of occupation: the insurance companies assign the various occupations to so-called hazard classes. Risk professions such as scaffolding or roofing fall into the highest risk class, and the contributions for occupational disability insurance are correspondingly high. Classic office jobs are naturally less risky, so the insurance premiums are also significantly lower.

The level of your own income and the desired level of coverage also influence the costs. Most insurers only pay for people who are 50 percent or more disabled. If you want to receive benefits earlier, you have to pay higher contributions.

Of course, the desired pension level also plays an important role - the higher the later desired pension, the more you have to pay into the insurance every month.

Last but not least, age is decisive for the amount of the contributions. Because with age, the risk of falling ill and of being unable to work increases. Therefore, for reasons of cost, it is advisable to take out disability insurance at a young age.

Disability insurance - what to look out for?

However, whether you are insured at all and which conditions then apply depends on something else: your previous medical history. Before you can take out disability insurance, you have to inform the insurance company in detail about previous illnesses. It is important to release the treating physicians from their duty of confidentiality, because they have to provide the insurers with the relevant documents.

This duty to inform should be taken very seriously. Because if you keep silent about having been treated for a depression, a slipped disc or other, even minor, illnesses, you risk insurance cover.

Psychotherapy as an exclusion criterion?

For example, if you have already undergone psychotherapeutic treatment because of burnout or depression, the chances of affordable occupational disability insurance are poor. However, it is imperative that you specify the therapy, otherwise the insurance will not have to pay in an emergency.

If the psychotherapy was already a few years ago, the chances increase again. In any case, however, you will have to pay a risk premium that increases the monthly insurance premiums.

compare offers

It is also important to obtain and compare several offers before concluding a contract. Experts advise against choosing the cheapest option. Because this is usually associated with a low payout amount and often includes stricter exclusion clauses.

Therefore, pay close attention to the insurance conditions and read the small print carefully. In this way you avoid unpleasant surprises in an emergency. You should also find out about the waiting times before the first payment. Some insurers do not pay until six months after submitting the application or even later.

Pension amount, legal protection and more

The amount of the disability pension also needs to be carefully considered. Experts recommend that you set aside no less than 1,000 euros per month. If you have a lower pension, you have to apply for additional state basic security, which is then offset against the BU pension. It is customary to secure 75 to 80 percent of the last net earnings.

In addition to your disability insurance, you should take out legal protection insurance. Experience shows that many insurance companies initially reject applications for disability pensions. With legal protection insurance behind you, you can also legally enforce your claims without financial risk if necessary.

After you have signed a contract, you should regularly check whether it still fits your current life situation. It can make sense to adjust the contribution amount as your income rises in order to later achieve a correspondingly higher disability pension. Also, be sure to pay your dues on time. Otherwise your insurance cover can expire quickly.

What happens in an emergency?

A fall from the ladder, a wrong move, an unfavorable movement - the emergency is there. It's good that you have private disability insurance. But what must be done now so that the pension flows as quickly as possible?

First of all, you have to submit an application to your disability insurance. The insurance company then begins to check whether and to what extent they are unable to work. This decision depends on various factors, including information from your treating physicians and independent medical reports.

The exam can take several weeks or even months. During this time, you will have to continue paying your premiums with many insurance companies on time, otherwise you will lose your insurance cover. Only after it has been decided that you are unable to work and that you will receive a pension does your insurer usually exempt you from contributions.

Caption: Combination with old-age provision?

Some insurance companies offer a combination of old-age provision and disability insurance. The occupational disability insurance can be combined with an ongoing private pension insurance or a term life insurance (additional occupational disability insurance).

However, consumer advocates advise against these combination products. Because they are generally more expensive than an independent occupational disability insurance. This is why there is a tendency to set the desired disability pension too low in order to keep the contributions low.

In addition, you are less flexible if your own income should decrease in the course of working life - if you then reduce the contributions or even cancel the insurance, you not only save the contributions to the pension, but also lose insurance cover in the event of a later occupational disability.

Cancel insurance

The notice period is regulated in the insurance contract. Normally, independent occupational disability insurance can be canceled annually, depending on the term of the contract, giving one month's notice to the end of the term. The notice periods for supplementary occupational disability insurance depend on the information in the main contract for the pension or Term life insurance set conditions.

Most of the time you think about terminating your disability insurance if you suddenly earn less or have to cope with higher costs. But you should be cautious when you cancel your disability insurance - there is no money back, the premiums that have been paid in will not be reimbursed.

You also lose insurance coverage. Switching to another, cheaper tariff or provider also needs to be carefully considered. Insurance companies often ask for a new health check, which can reveal new illnesses over time, which in turn lead to higher premiums.

Insurance with periods of rest

In order to be able to react flexibly to financial bottlenecks, many insurance companies offer so-called rest periods, which can last up to six months. During this time, the policyholders do not have to pay any contributions, but do not receive any benefits in the event of occupational disability.

Tags: prevention Diseases first aid

-bei-kindern.jpg)